challenges to free and fair election in india

what are the challenges to free and fair election in India, most powerfull challenges to free and fair election in india

The BJP formed a majority government in India in 2024 and before that the Congress government was in power. The 10 years of the Congress and the 10 years of the BJP compare them on the basis of this. When Manmohan Singh was in power, the situation in the country was completely different from today. At that time, the Prime Minister used to hold press conferences, people had the freedom to protest against them, atrocities were not committed against them, government investigative agencies were not misused against opposition leaders during elections. Almost 90% of the elections were free and fair.

what are the challenges to free and fair election in india

But today’s situation is different. Everyone’s freedom is being taken away. The ruling BJP government is collecting billions of rupees through electoral bonds by threatening private companies by government agencies. If the farmer is not happy with the government and he is protesting, then lath is being rained on him, bullets are being fired, the internet of the protest place is being shut down so that the media cannot cover the protest demonstration. The media has been bought by paying money.

you are reading what are the challenges to free and fair election in India

challenges and hurdles regarding free and fair election

The media is not tired of praising the government, if a person in the media tries to speak against the government, then his channel is bought. What can a scared media do? He is also being forced to speak in favour of the Government. False cases are being launched against anyone who is working in the interest of the public in the opposition and they are being forced to join their side.

reading what are the challenges to free and fair election in india

free and fair election

If the opposition leader comes in favor of BJP, then the cases going on against him are closed, and if he does not join BJP, then he is sent to jail. The opposition leaders now have only two options either to join the BJP or go to jail. The BJP is not limited to this but has also toppled the elected government of the opposition in the state by intimidating their MLAs. Shortly before the election, the Congress bank account was frozen, so that the Congress could not contest the election.

almost about to complete what are the challenges to free and fair election in India ?

reimagining free and fair election

Many leaders like Hemant Soren, Arvind Kejriwal, Manish Sisodia, Satinder Jain were put in jail. Under the PMLA law, if the ED arrests someone, it was easy to get bail, that is, it was the right of the citizen to get bail, but the BJP made an amendment in this law in which a person will remain in jail until he is proved innocent, he cannot get bail.

Are election in India really free and fair

By reforming the PMLA, the BJP is misusing it, under which leaders are kept in jail for years in the name of investigation.

Now it seems almost impossible to have a free and fair election like this. In the state where the BJP was weak, that is, it was difficult to win the election, the BJP intimidated the leaders of the opposition in that state and included them in their favor.

you have completed the para of what are the challenges to free and fair election in india

main challenges for free and fair election

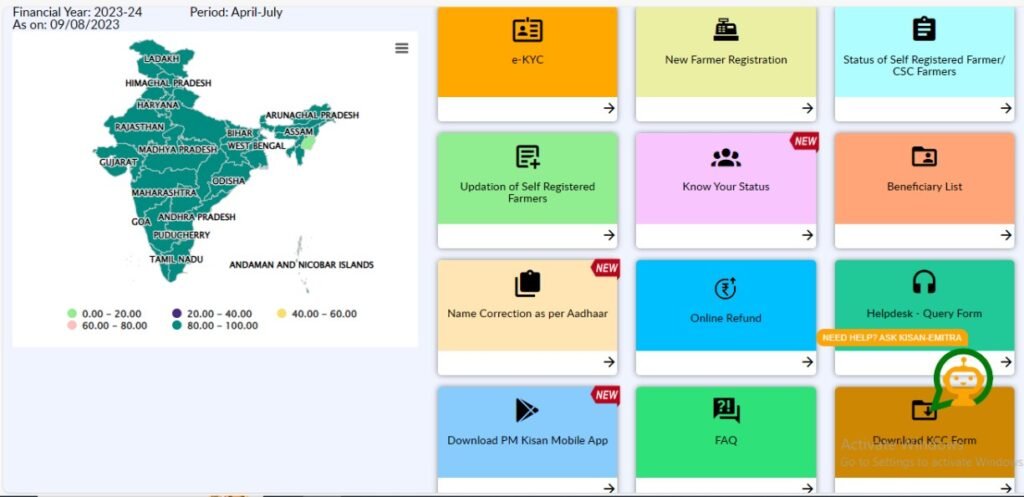

Now it comes to the Election Commission that it is neutral but earlier the President of the Election Commission was elected by the CJI, the Prime Minister and the 1 Leader of the Position, but the BJP changed this rule too. Now the CJI was removed and the Union Minister

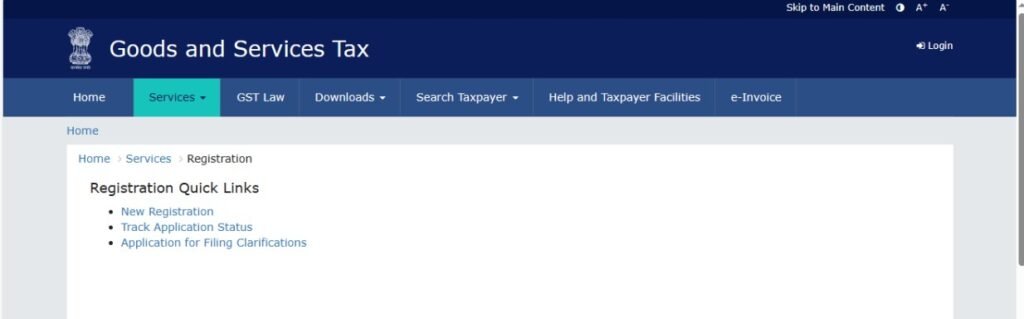

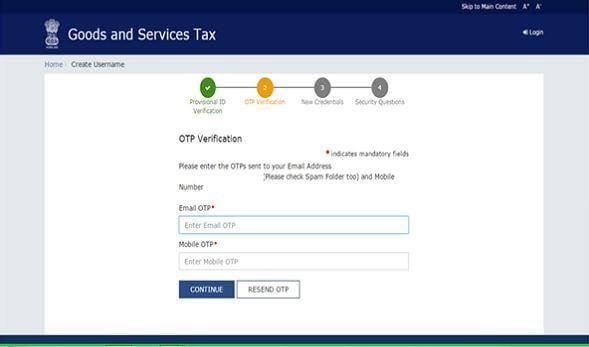

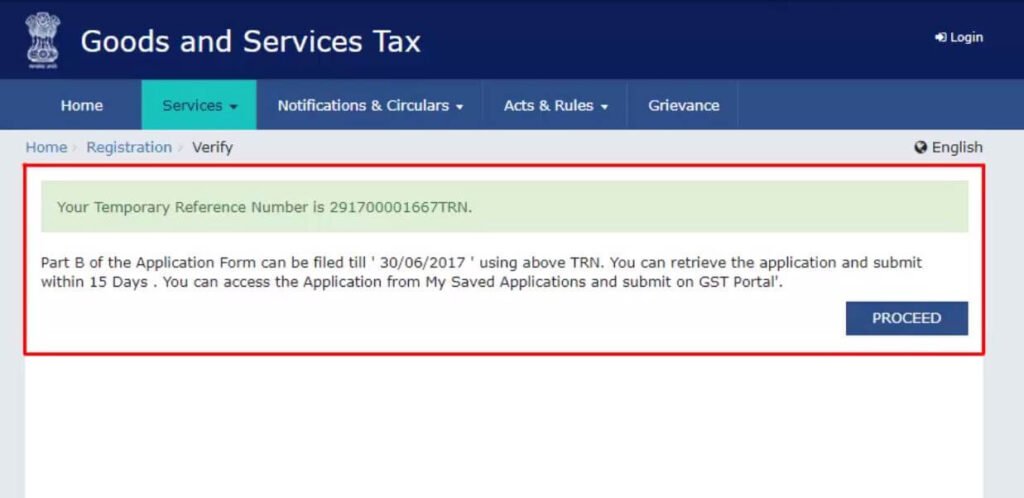

Also read How can I get passport in India

what are the challenges to free and fair election in India ?