The online GST Registration process needs to be completed on the official gst.gov.in website. Dealers are required to register for GST if their annual turnover above Rs. 20 lakh (or Rs. 40 lakh or Rs. 10 lakh, depending on the state and type of goods).

we would focus on how can I get GST number

Table of Contents

ToggleCan i get gst number without business

Can i get gst number without business

Step to Step guide how to apply for GST

The following people and companies need to finish their GST registration:

anyone who registered with the tax services prior to the implementation of the GST law.

Taxable individuals who are not residents and casual taxpayers

People who pay taxes via the reverse charge method

Every e-commerce platform

companies whose annual revenue above Rs. 40 lakh. For the states of Uttarakhand, Himachal Pradesh, Jammu & Kashmir, and the Northeast, the business’s turnover must surpass Rs. 10 lakh.

wholesalers of input services and supplier representatives.

those that provide things via an online marketplace aggregator.

individuals who, other from those who are registered taxable persons, give residents of India access to databases and online information from outside the country.

GST registration is mandatory for businesses that have an annual turnover of Rs.20 lakh and more.

- you are reading how can I get GST number ?

GST number eligibility

.The list of paperwork needed for GST registration is as follows:

Adhaar card

PAN card

Details of a bank account

Evidence of address

Digital signature image (up to 100 KB in size, in JPEG format)

Memorandum of Association/Articles of Association

The Ministry of Corporate Affairs issued the certificate of incorporation.

Evidence of the authorized signatory’s appointment

The LLP Board resolution and registration certificate

Step by step process

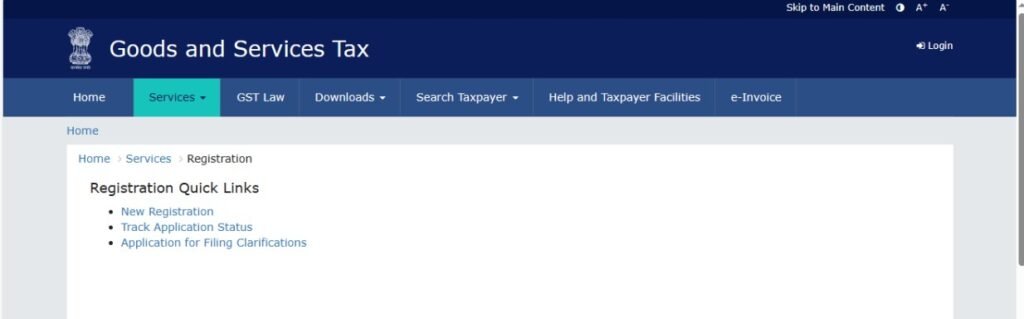

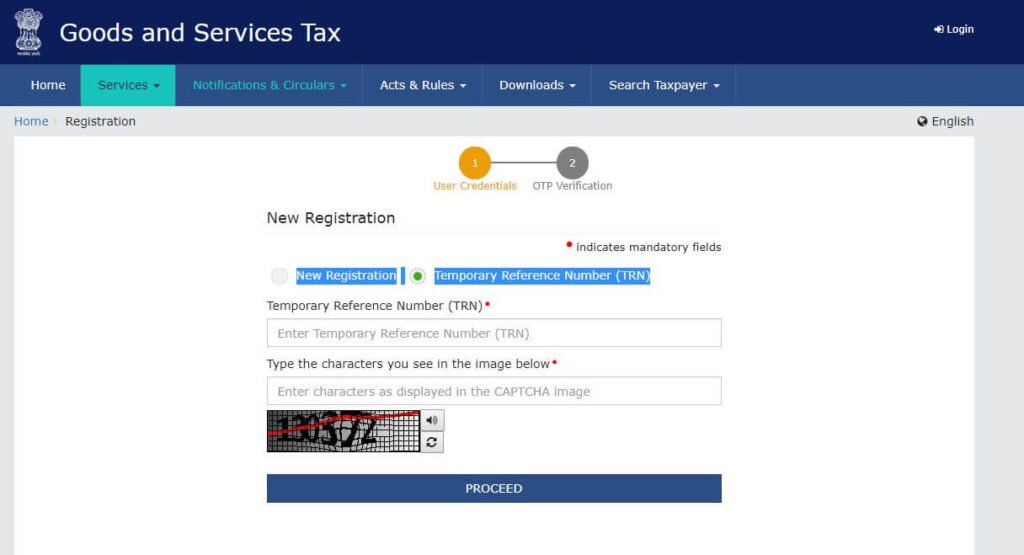

Step 1: Visit the GST website. Select Services. Next, pick “New Registration” after clicking the “Registration” option.

Step-2

Fill out Part A with the following information:

Click the radio button for “New Registration.”

Click the “I am a” drop-down menu and choose Taxpayer.

Choose District and State from the drop-down menus.

Key in the email address and mobile number. Enter the business’s name and PAN. Please be aware that if your contact information is connected to your PAN, you do not need to enter your email address or mobile number.

OTPs will be sent to the registered email address, mobile number, or PAN-linked contact information, whichever is applicable.

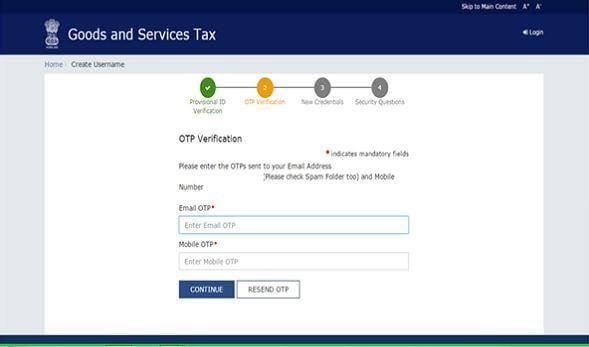

Step -3 Enter the two OTPs that you received via email, mobile, or PAN-linked contact information. Press the “Continue” button. Click Resend OTP if you haven’t received the OTP

you are reading How can you get GST number

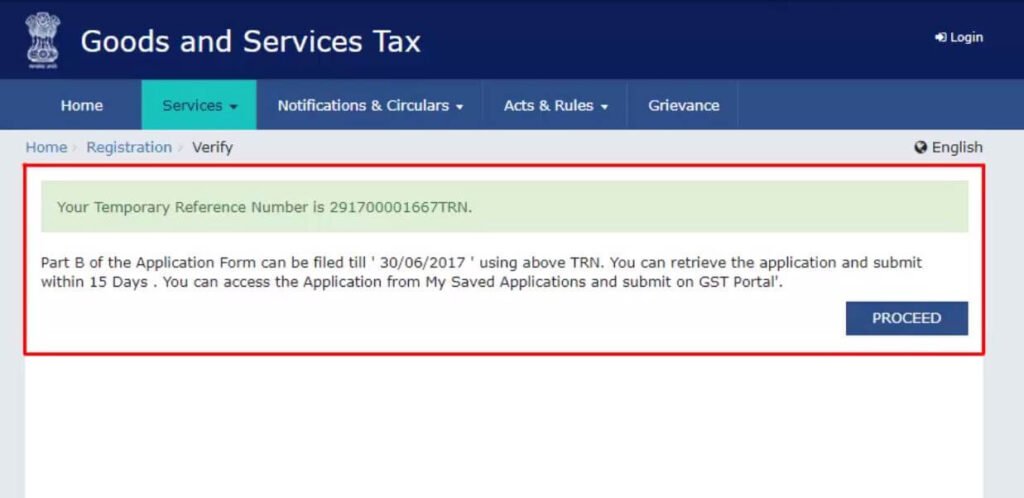

STEP -4 The 15-digit Temporary Reference Number (TRN) will be sent to you right now. Your email address, mobile number, and PAN-linked contact data will also receive this. Make a note of the TRN. Within the next fifteen days, you must finish entering the part-B details.

Step 5 – Once again go to the GST portal. Select the ‘New Registration’ tab.

Reading – how can I get GST number

Step-6 Choose the Temporary Reference Number (TRN) in Step 6. After entering the captcha code and the TRN, click Proceed.

Step 9 –There are ten sections in Part B. Complete all fields and attach the necessary files. In 2020, the bank account component became optional and the Aadhaar authentication portion was added.

Here is the list of documents you need to keep handy while applying for GST registration

Images Taxpayer’s Constitution Documentation for the business location

Bank account information* Aadhaar authentication and verification, if selected* Since December 27, 2018, bank account information is not required at the time of GST registration.

This is for How can I get GST number ?

Watch this video to learn more about the paperwork needed for GST registration.

Step 10 –Enter the trade name, business constitution, and district under the Business Details section.

Note: The trade name and the business’s legal name are entirely distinct.

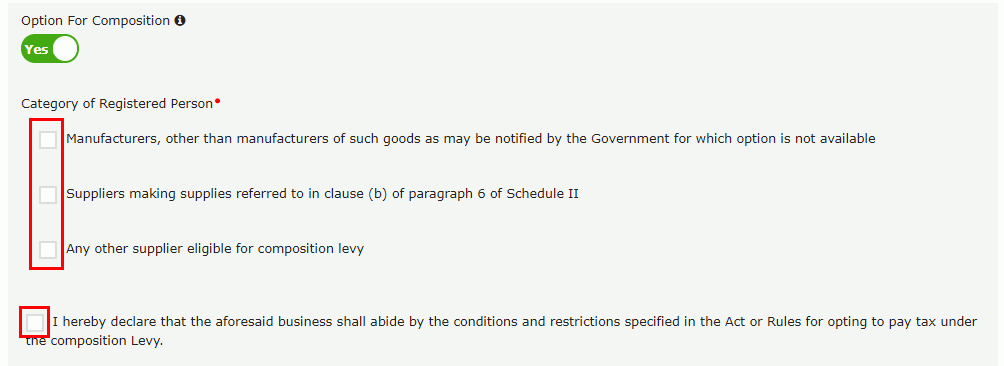

Next, check the box next to “Option for Composition” to indicate whether you want to opt in or out of the composition scheme. Additionally, select the registered person category, such as manufacturers, service providers for labor contracts, or any other individual qualified for the composition scheme.

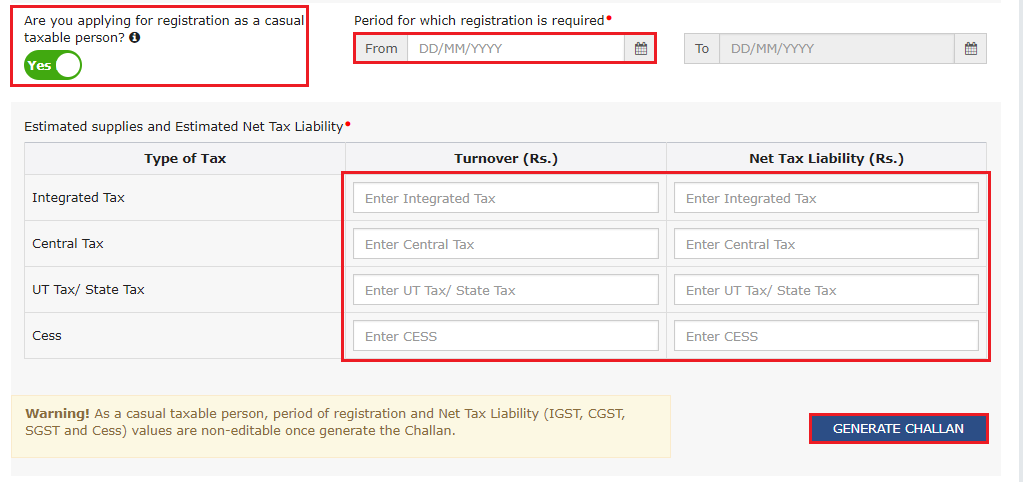

Next, input the date that the business started and the date that liability started. Additionally, choose “Yes” or “No” for the kind of registration as a casual taxable person. If “Yes” is selected, create the challan by providing the information required to pay the advance tax in accordance with the GST rules for casual taxable individuals.

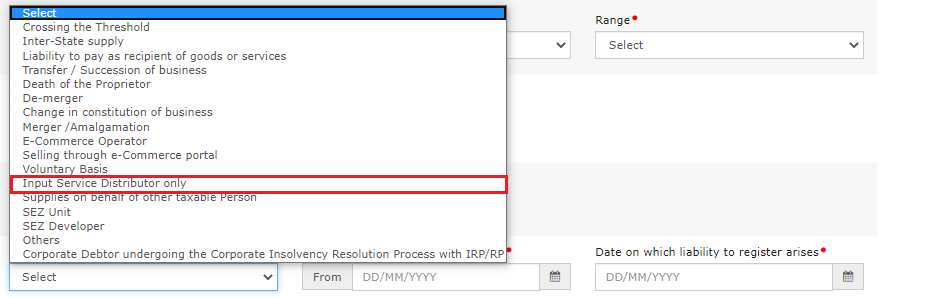

alternative, there are a plethora of other possibilities to select from.

Enter information in the fields that display based on the choices that was made. If you choose “SEZ unit,” for instance, you can upload the supporting documents and input the SEZ’s name, approval order number, designating authority, and other details.

Select the type of existing registration (Central Sales Tax, Excise, or Service Tax), along with the registration number and date, in the Indicate Existing Registrations area. Next, press the “Add” button.

When the information is entered, you’ll notice that the tile becomes blue, signifying that the section’s details have been filled in.

Step 11 –You can enter the information for up to ten Promoters or Partners under the Promoters/Partners page.

PAN and Aadhaar numbers must be submitted, along with personal information like name, address, phone number, date of birth, email address, and gender; if the taxpayer is a company, identity information like Director Identification Number and Designation / Status and PAN must also be entered.

Make the appropriate choice if the promoter is also the primary authorised signature. To continue, click the “SAVE & CONTINUE” option.

Step 13 –Add the details about the principal place of business.

The major location where the taxpayer does business within the state is considered their principal place of business. The address where the company’s president or upper management is located, along with the books of accounts and other papers, is typically designated as the principal place of business.

Next, upload any supporting documentation, such as a letter of consent or a NOC for a business operating on rented space, as well as any documentation proving the SEZ developer’s approval or the SEZ unit’s approval, if any. Additionally, note any additional business locations and highlight the type of commercial operations conducted on the property. Select “SAVE & CONTINUE” from the menu.

Step 15 –Next, provide the taxpayer’s bank account information for a maximum of ten bank accounts. The submission of bank account information is no longer required as of December 27, 2018. When you log in to the GST site for the first time, you will be prompted to file a non-core modification application in order to submit the bank details if you failed to report these details at the time of GST registration and after GSTIN is granted.

Step 17 –Next, decide if you want to complete the Aadhaar authentication process. Visit our website “Everything you need to know about Aadhaar authentication and steps” to find out more about the procedure and the choices available.

Next, decide if you want to complete the Aadhaar authentication process. Find out more about the procedure and your options by visiting our page.

Step 18 –

Proceed to the Verification page after filling out all the information. Mark the statement and send in the application in one of the following methods:

Businesses and LLPs must use DSC to submit applications.

An OTP will be delivered to the Aadhaar registered number via e-Sign.

An OTP will be issued to the registered mobile device via EVC.